Aging in place is the decision to remain in your home and community as you get older.

It can be a way to maintain independence, stay connected to loved ones, and avoid the cost of moving to a retirement home or assisted living facility.

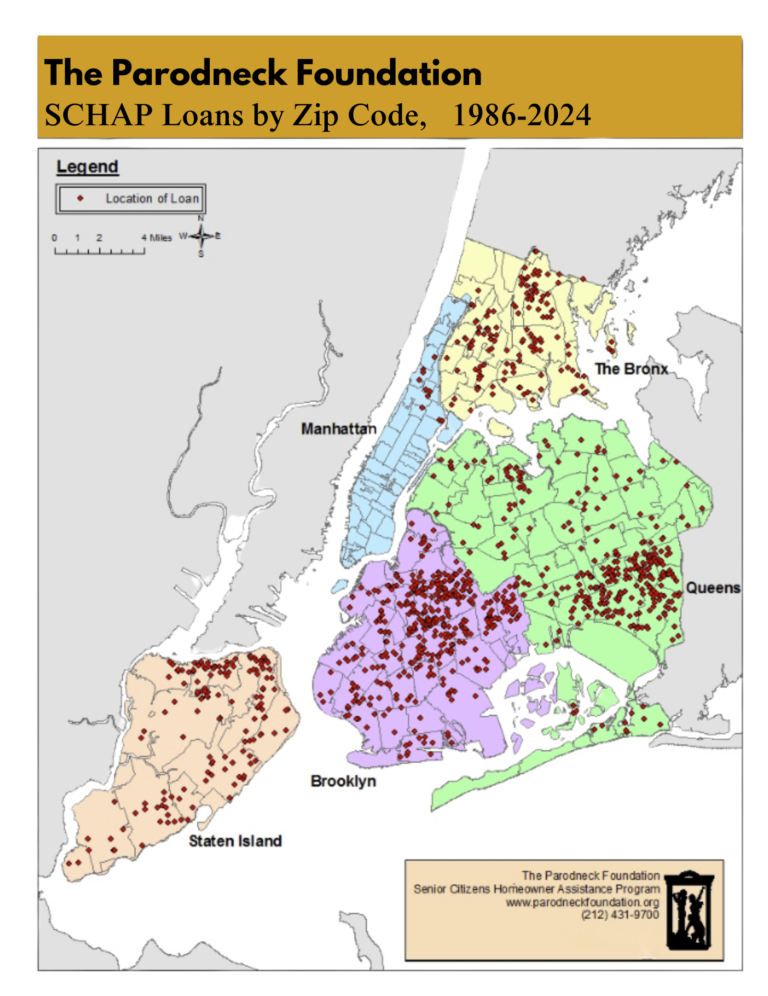

SCHAP offers affordable loan programs to help seniors cover the costs of necessary home repairs, reducing financial burdens.

SCHAP helps NYC homeowners maintain safe and secure homes by providing critical home repairs and modifications

To be eligible, homeowners must reside in any of the five boroughs in the City of New York, be at least 60 years old, and have been an owner-occupant of a one- to four-family home for at least two years. Also, be current with their mortgage loan and NOT have a reverse mortgage on their home.

**We have expanded this program to include non-senior homeowners but have limit funding.

Parodneck Amortizing Loan Fund (RLF)

This product includes low-interest (3%) repayment loans that can be used to cover the costs of home improvements. This loan is repaid monthly over a ten-year (120 months) period. Borrower pays an origination and loan-processing fee of 3% of the principal amount; they remain fully responsible for all applicable recording fees.

Parodneck 10-year Deferred Loan

This product includes interest-free loans, origination and loan-processing fee of 3% of the principal amount for home improvement. Upon the 10th year (120 months) loan anniversary the loan is to be repaid in full.

Affordable Housing Corporation (AHC)

Grant amount is leveraged with one of the above listed loans. For households with less than 112% of Area Median Income; terms vary based on loan amount (2, 5 or 10 years)

You must be logged in to post a comment.